All businessesdeal with churn. Every organization struggles to keep their existing customers despite most places noting that it is their top marketing priority. It is worth doing as your profits can increase by as much as 95 percent if you can master customer retention, but only a few know how to do it effectively.

Luckily, there are some excellent ways to reduce your churn rate and retain customers.Sure, you might need to modify them to your situation, but these methods should allow you to provide continuing value to your customers.

Your business should see substantial growth by implementing these methods, but only if you choose the ones that best match your customers. Therefore, by reading further, you will also learn how to properly measure your customer retention.

What is Customer Churn?

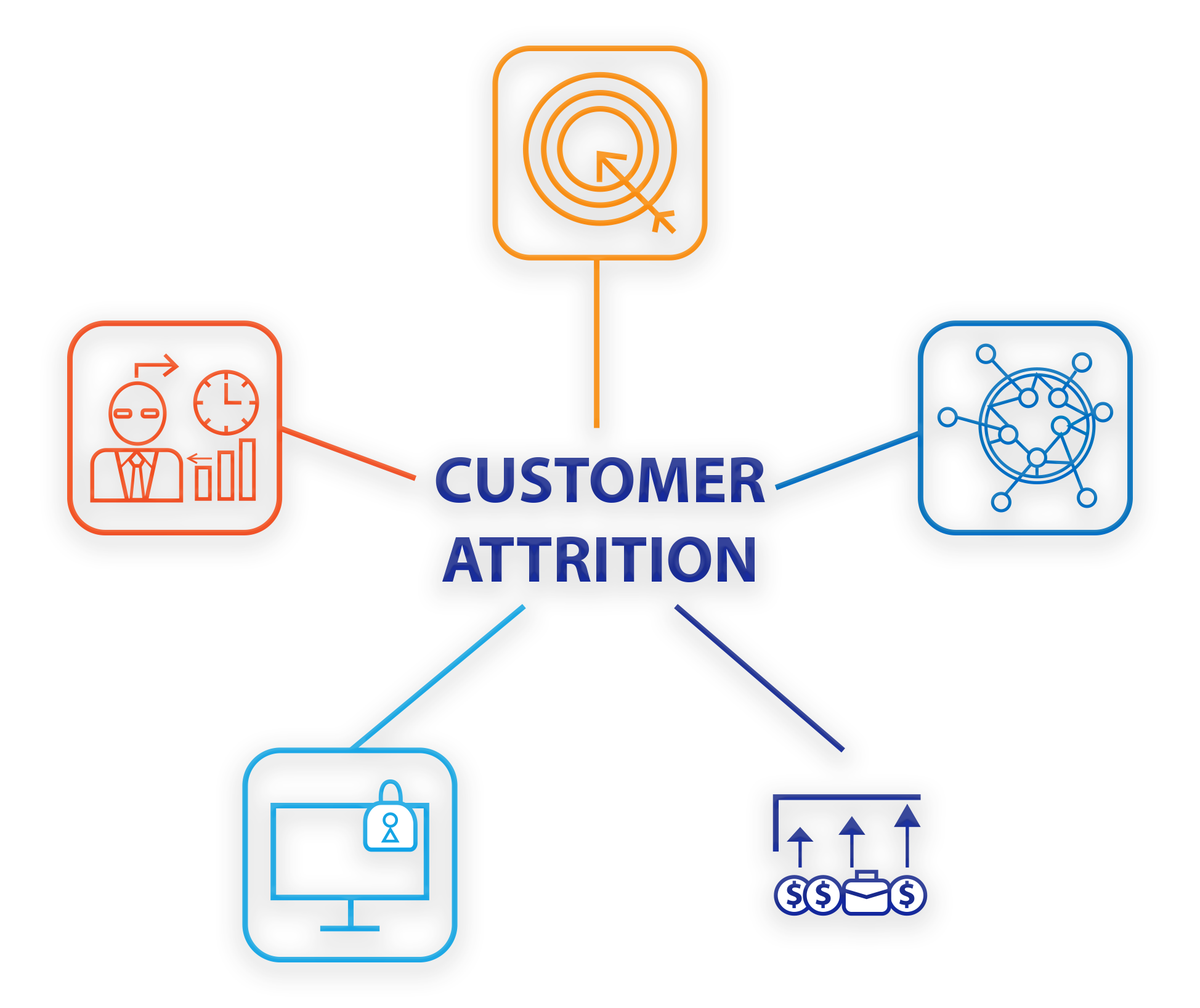

Your customer churn rate represents the percentage of your customers who leave after using your company’s products or services during any given period. Also known as customer attrition, you get it by dividing your lost customer count by your initial customer base for a given quarter. Despite being a regular percentage, it often takes different forms depending on the needs of the business.

Your organization can experience customer churn if:

- Your customers found a more cost-effective solution to their problems elsewhere.

- Your products and services poorly fit the market segment.

- Your brand’s digital presence provides a poor user experience.

- You are not providing a positive customer experience.

These factors are not mutually exclusive, and your organization may suffer from any combination of them. However, they may not be the fault of your business. Churn can take multiple forms depending on the state of the market. Some of these forms may be desired as well.

How to Identify Customer Churn

Because churn happens for numerous reasons, you must know how much churn you have before you try to minimize it. Taking the wrong measures can do more harm than good.

Establish Customer Churn Metrics

Therefore, you want specific metrics that define what churn means for your company. It could be the number of installed or canceled subscriptions if you have a digital product or app, Otherwise, it can be product returns over a defined period.

You want to establish these metrics, along with your churn thresholds, as soon as possible. You can use these thresholds to flag which customers are about to churn so you can attempt to rectify their concerns.

Gather Customer Feedback

Many customers prefer making their unhappiness to you directly. Therefore, you should gather customer feedback about your brand. You can do this through a dedicated survey or a feedback form on your website. You should also check for feedback through your brand’s social media profiles.

Tap Your Customer Success Team

While you want the feedback, you should ask your customer success team to initiate the discussion. It is their job to monitor and maintain your brand relationship with your customers. As such, they are probably already working with the customers long before they fall under one of your churn metrics.

Prioritize Proactive Customer Service

A proactive customer service program tries to identify and solve issues before they impact your customer experience. As such, these programs can flag potential sources of churn before they happen.

Monitor Community and Third-Party Forums and Review Sites.

Never overlook your community forums or any third-party review sites in your industry. You can leverage these customer communication tools to identify potential sources of churn. You can also use them to flag which customers may churn so you can work with them.

Ways to Reduce Customer Churn

Now that you know why your customers churn, you can start preventing it. Some of the following methods will work in all situations. Others may only work in certain cases or industries. Either way, they are all worth evaluating their benefits to your organization.

Concentrate Your Efforts to Your Best Customers

Many businessesbelieve they must refocus their efforts to keep every churning customer. However, redirecting your time and resources to your best, most profitable customers might be a better strategy. Because customers churn for a variety of reasons. you want to put your efforts where they would best maximize profits.

Use Proactive Communication

Many customers churn because they feel their issues are ignored. Therefore, you can prevent them from churning by helping them get the most value out of your product or service. Just make sure your outreach focuses on your brand can help your customers meet their needs.

Define roadmaps for Your New Customers

Learning to use a new product or service can overwhelm anyone. If your customers cannot effectively use your product, they will quickly lose interest in it. Therefore, you want to establish a roadmap to guide your new customers through each feature, process, and functionality. That way you can easily manage customer expectations at an appropriate pace.

Done right, your customers will feel empowered to achieve success, making them unlikely to leave.

Offer Your Customers Incentives

The best way to retain customers is to give them a reason to stick around. You can offer anything from promotions, discounts, loyalty programs, or anything else that might serve their needs. The effort will show you appreciate and value your customers.

Ask for Frequent Feedback

Your customers want to be heard. If your product or service frustrates them, they want you to provide quick effective support that solves their issue. However, your customers might be vague in their communication. Therefore, you must continuously collect feedback.

You can collect this feedback through regular surveys, feedback forms, live chat, email messages, or a simple phone call. Either way, you will show your commitment to improving your products and services to your customers.

Analyze Churn as It Happens

Once customers leave, it is too late to try to mend your business relationship with them. Therefore, you should use their data to develop strategies to prevent other customers from churning. Churning customers are a sign that your customer experience is lacking something important. Therefore, use the opportunity to improve your company.

Your analysis should be aligned with your churn metric thresholds. For instance, you can track how long it takes before yourcustomers churn. You can then gather feedback to learn why they churned. In time, you will be able to predict which customers will churn and when allowing you to service these at-risk customers better.

Stay Competitive

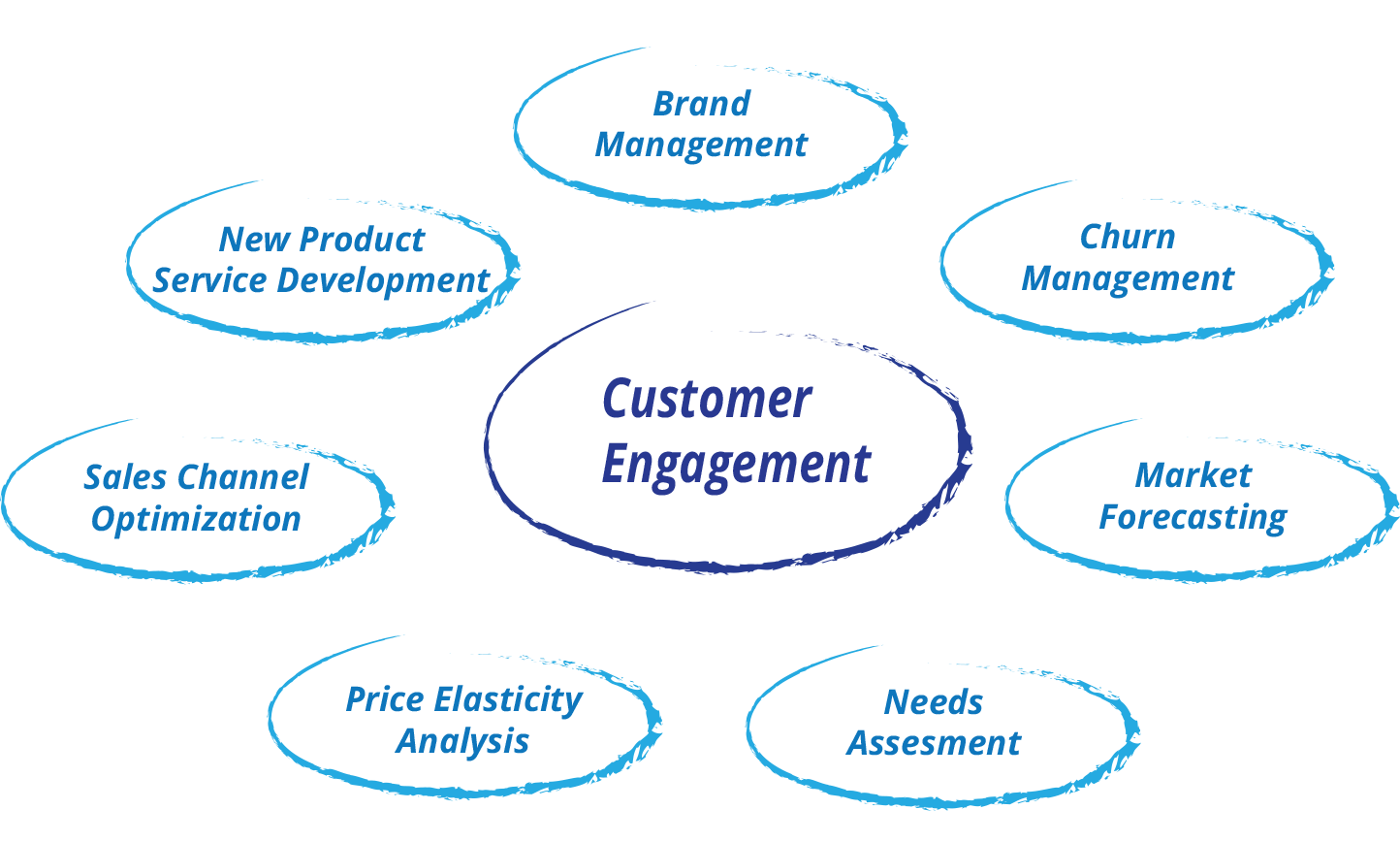

Market conditions constantly change along with customer expectations. As such, organizations that focus on such things as technology, trends, and product advancements tend to avoid disruption and unexpected competition.

However, you must do more than just keep your products and services on the cutting edge. You also want to ensure your customer success and support programs remain relevant as well.

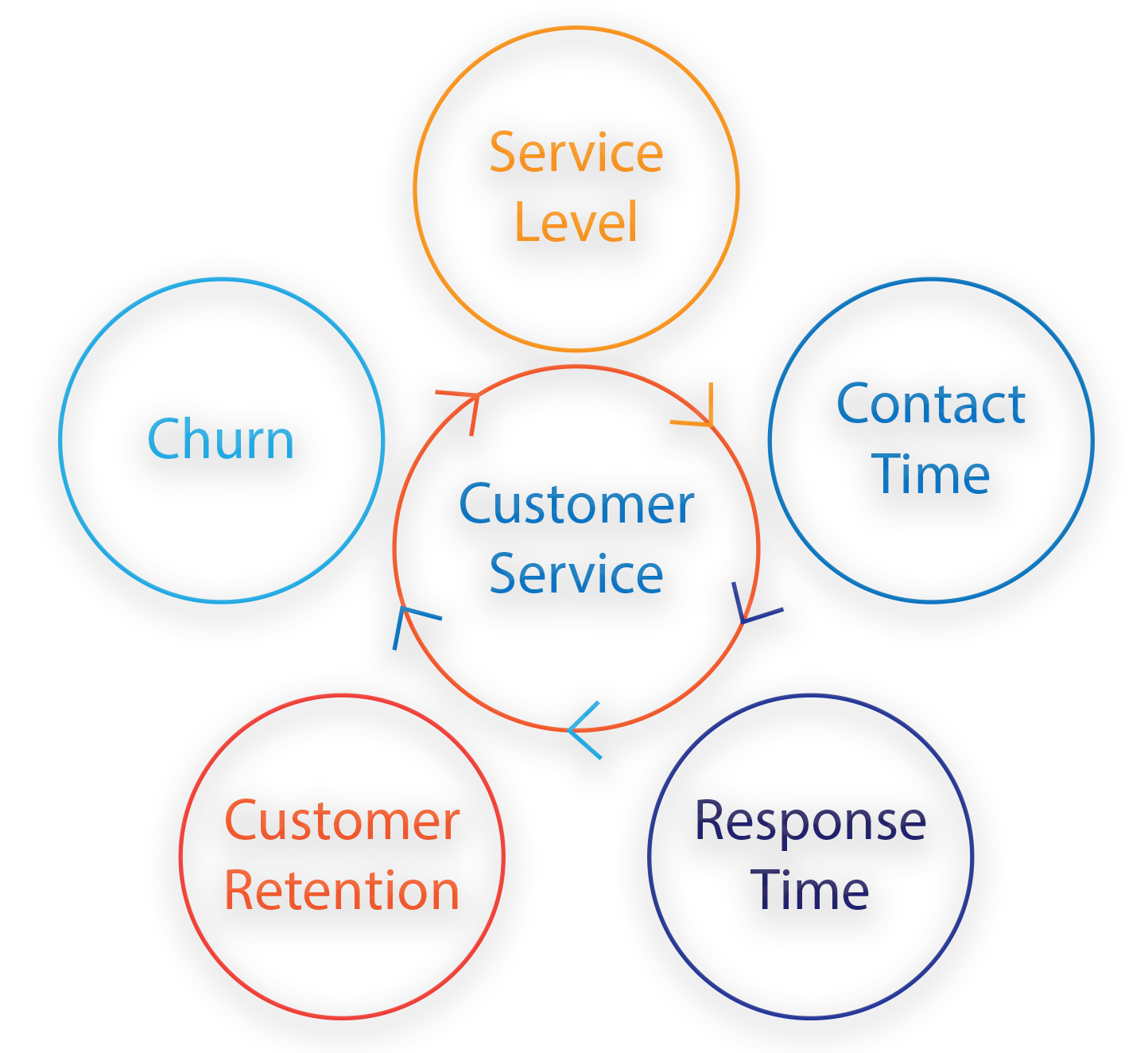

Provide Excellent Customer Service

As most reasons for customer churn are service-related, you want to ensure your customer service program is the best it can be. Empower your service representatives to solve your customers’ problems and inquiries, even if that means spending money to please customers.

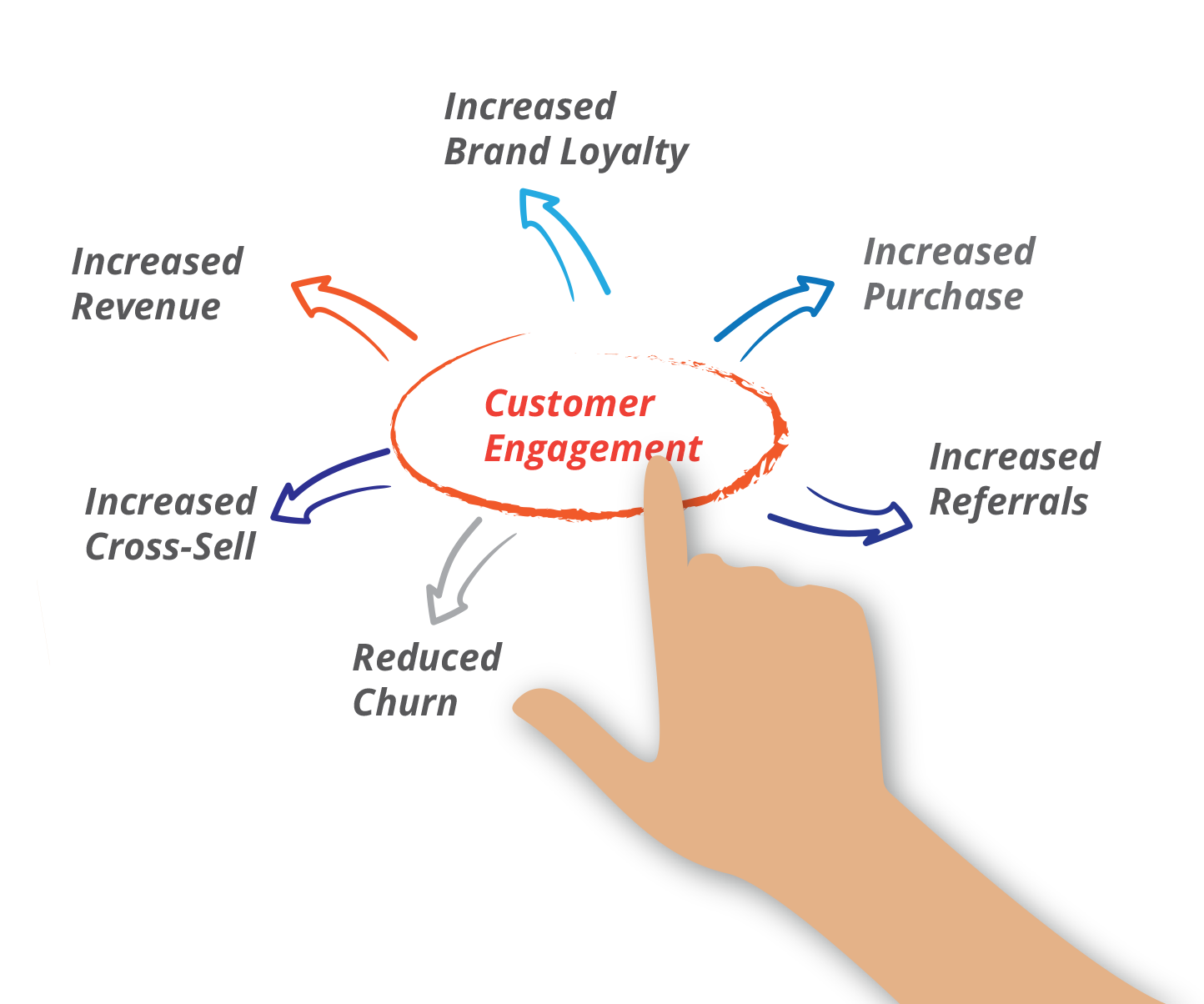

Create a Community for Your Customers

Customers are loyal to brands that have strong communities around them. Therefore, you can reduce churn by letting your marketing team establish a community for your customersthrough engagement through social media and other relevant outlets.

Assign Customer Success Managers to Your Most Valuable Customers

Your customer success program should be a key player in your attempts to reduce customer churn. Your customer success managers will ensure your most valuable customers have their needs sufficiently met. They also help streamline feedback and service requests.

When to Focus on Customer Retention Instead

While you deal with your churn rate, you should never overlook your customer retention strategies in the process. While reducing churn will increase retention, they define different things.

Customer retention collects all the efforts your business makes to increase repeat customers and make each customer more profitable. Retention strategies help your organization get more value from your existing customer base. If done right, you will inspire your customers to stay with your brand.

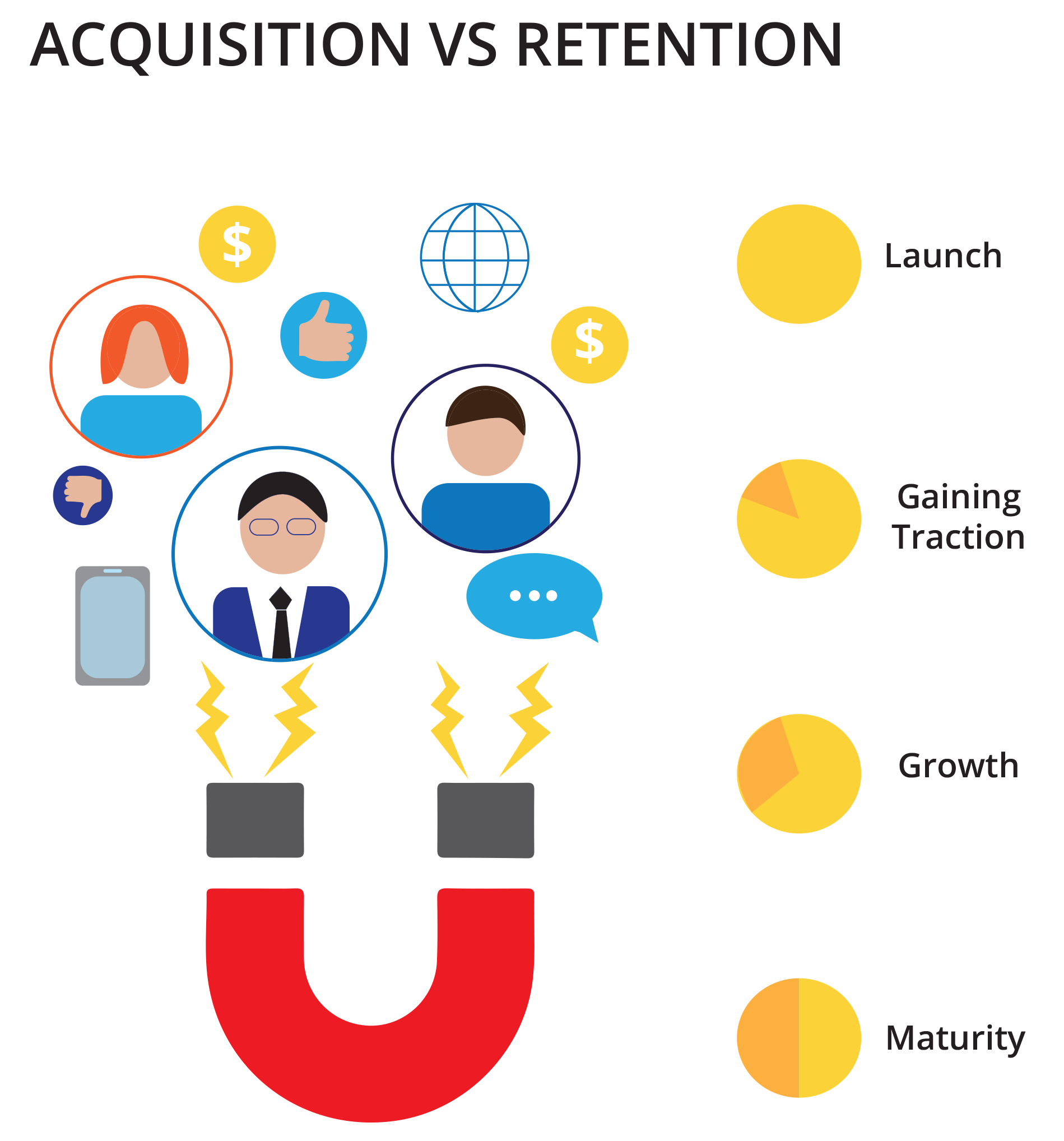

How much you should focus on it largely depends on where your company is in its lifecycle. A young company has vastly different retention needs than one that has been in business for decades.

- Just starting -new businesses should focus on acquiring customers before considering anything else.

- Gaining traction–Once you have a customer base, you can start tackling retention to encourage your customers to buy more.

- Consistent–Once your business is sustainable, you should split your efforts evenly between customer acquisition and retention while seriously considering your marketing automation efforts.

- Established–Established organizations should have series and deliberate customer retention efforts

- Well-established–Well-established companies should go heavy on retention.

Beyond these moments, your customer retention efforts should reflect the expectations of your current customers. As such, they should reflect the needs of your product or service.

Customer Retention Metrics That Matter

To improve your customer retention rate, you must understand the underlying metrics. These metrics provide insight into the minds of your customers. They show you what works and where you need to improve. While time-consuming, they can help you fine-tune your customer journey for your base.

Repeat Customer Rate

Your repeat customer rate sits at the heart of your customer retention efforts. It measures the percentage of customers willing to make additional purchases from you, revealing the quality of your retention efforts. You calculate the rate by dividing your total number of repeat customers by your number of unique customers.

Customer Retention Rate

The retention rate is an alternative to the repeat customer rate. It is the weighted ratio of your repeat customers to your initial customer base for a given reporting period. It is functionally the opposite of your churn rate.

You measure it by subtracting your number of new customers from your total customer count at the end of the period. You then divide the result by your total customer count from the start of the period.

Customer Churn Rate

Your customer churn rate is a good indicator of your customer retention. For instance, high churn means low retention.

Purchase Frequency

Purchase frequency reveals how often your customers make purchases.It indicates how much your customers enjoy your products and their willingness to try out your competition. It can also identify your organization’s strengths and weaknesses when paired with other metrics such as customer satisfaction.

You can find your average customer purchase frequency by dividing your total number of orders by your total number of unique customers.

Average Order Value

Average order value reveals how much money your customers are willing to spend on your products. You measure it by dividing your total earned revenue by the number of orders.

Customer Lifetime Value

Customer lifetime value (CLV) measures the revenue you earn from a single customer. Your customer values are so important to your business that you should consistently track them over the lifetime of a customer. Ideally, it should remain steady or rise as low CLV may indicate low-value customers or a high rate of churn.

You can calculate a CLV for each customer or an average comprising everyone. Both offer insights for your customer retention efforts.

- Individual CLV –Measure the average expected revenue for a given customer then multiply it bythe average customer lifespan

- Average – Take the ratio between your gross sales by your total unique customers

Revenue Churn Rate

Your revenue churn rate measures how much revenue you lost from your existing customers. It is highly correlated with your customer churn rate butmay reveal false flags such as customers choosing a lower-tier service plan.

You calculate the rate by determining the differencebetween your monthly reoccurring revenue (MMR) at the start and end of a month. You then subtract the result by your accrued revenue from upselling and cross-selling to your current customers.

Other Customer Retention Metrics to Consider

Besides the metrics above, you may find that other popular metrics may offer some benefits to your customer success team. For instance:

- Existing Customer Revenue Growth Rate

- Purchase Return Rate

- Days Sales Outstanding

- Net Promoter Score® (NPS)

Conclusion

While customer churn is a natural part of doing business, you want to minimize it as much as possible. Through the right metrics and techniques, you can retain more customers and generate more revenue.

If you need help deciding on which metric or churn reductiontechnique your organization should use, feel free to contact us right away. Our representatives will work with you to determine the best way your business can maintain a stable customer base.

Leave a Comment