How do you improve sales for your financial institution?

There are several things to consider when looking at strategies for improving sales in financial institutions. Increasing your financial book of business not only involves attracting and converting new profitable clients but also maximizing existing opportunities by meeting the diverse and specific needs of your existing clients.

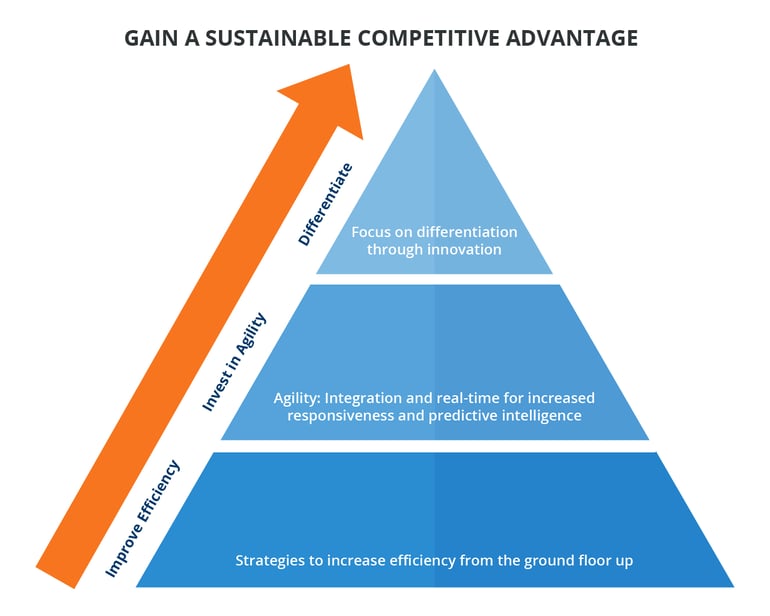

Technology is advancing very quickly, providing more options for increased revenue in brokerages, retail, corporate, and investment banking. In today’s competitive marketplace, financial institutions can grow their business through strategies that increase their efficiency, differentiation, and agility.

Ways to go about increasing efficiency for improved sales

There are several ways for financial institutions to increase efficiency from the ground floor up.

- Focus on making the necessary technological changes needed to stay competitive in the industry. After all, we are living in a world today that is primarily dominated by digital solutions. Is your financial institution effectively and efficiently prepared to best your clients’ overall needs?

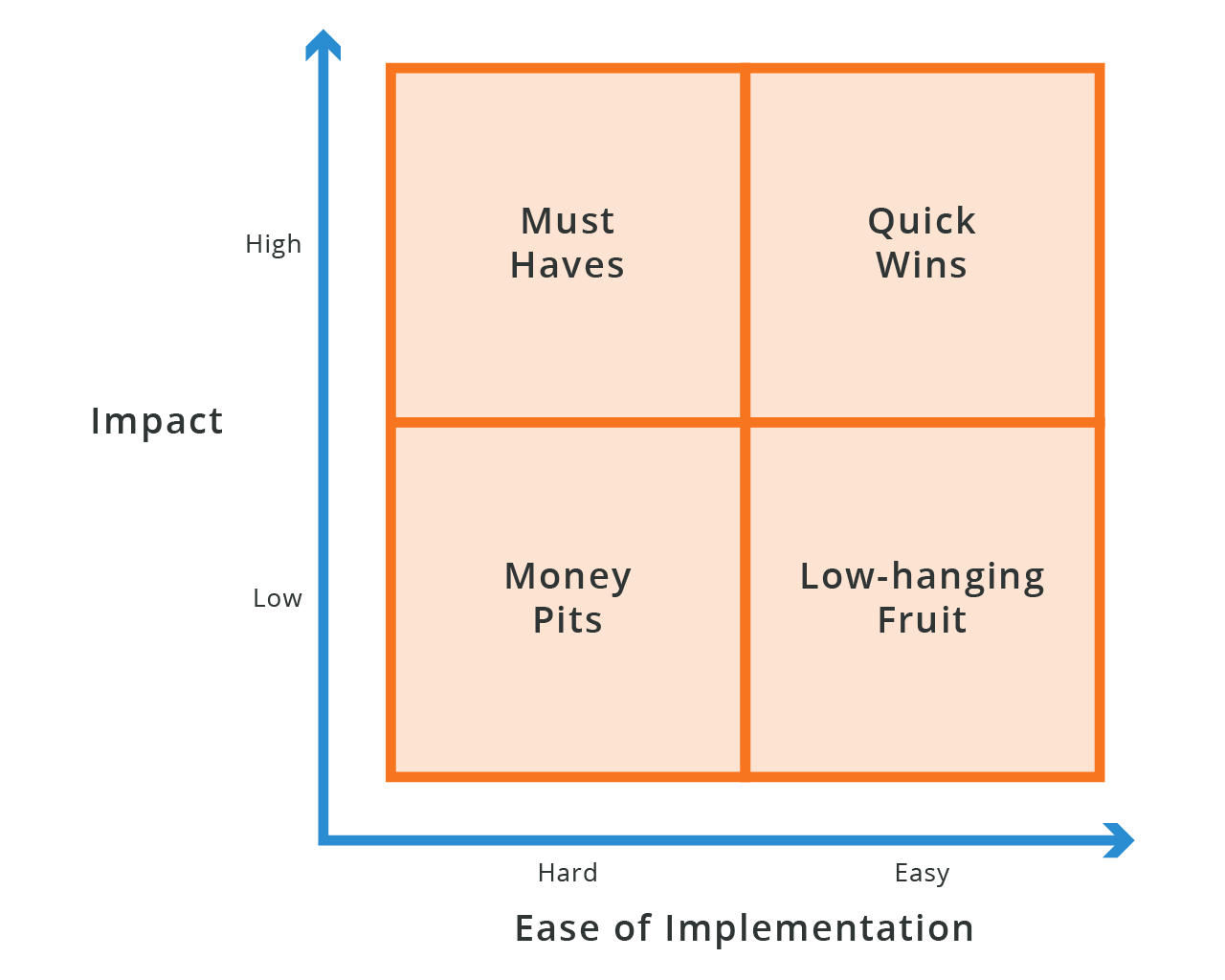

- Look at using Strategy Prioritization, or SPM approach, to help identify your initiatives from a potential wish list of hopes for the future. This tool is quick and easy to use and is broken down into 4 specific categories.

- Look at opportunities for using online storage facilities and cloud computing, so that people in different departments, cities and even countries can have access to the same tools, services, and client base.

- Integrate your front and back office systems so that your staff can focus on your core business. Work with the IT department to ensure that they can accurately install and maintain the integrated system needs.

- Ensure that the technology you’re using can best track data related to the new prospect and client demographics, contact information, history, and trading activities. Does it provide a 360-degree view of your business in real-time? The latest in predictive intelligence, automated workflows, predictive lead scoring and analytics to power your sales and marketing teams with insights to pursue and close the best deals?

- Increase ease of use for clients. Let’s face it, in the majority of cases, it is much easier to go online and transfer funds, apply for a loan, open a new account, pay bills, make trades, and so on. When these online channels are also integrated with your call centers and branches, sales journeys that are started online can also be completed with a simple phone call or a quick, scheduled visit to a local branch. Many financial institutions view ‘anytime, anywhere’ channels, underpinned by access to customer information in real-time, as more of a strategic growth opportunity than branches. Salesforce Financial Services Cloud is focused on wealth management systems which allows advisors to connect with clients in a way that benefits both your institution and your clients.

One new feature that is also starting to be utilized more often is mobile banking, Web 2.0, remote check capture feature. This makes it possible for individuals and businesses to just simply go to the appropriate mobile banking application, take a picture of their check, and submit for deposit. This is helping to move funds quicker and safer so sales can occur in a timelier fashion. After all, the future of mobile banking is moving very quickly.

Introducing CRM technology for agility in closing more financial sales

According to Accenture financial institutions will need to revamp their operations by 2020 to become more digital, truly customer-driven, omnichannel (allowing banks to interact with customers through all available means, including new mobile technologies), and innovative.

In today’s financial institutions, more sales are conducted online than ever before. There is a strong need to conduct business quickly via mobile phone, by talking to representatives via online chat, email, and a variety of other options.

This is where the need for integrated CRM technology is quickly becoming more necessary than ever. Clients need to have products and services provided accurately and as quickly as possible, salespeople need to be able to identify the best sales prospects while providing personalized advice, all of which are rooted in superior client relationship management.

The overall integration of the sales and marketing departments, where agile actions are powered by real-time information, analytics, and even predictive intelligence, along with back-office functions is extremely beneficial. This also helps add loyalty to the business, aims to ensure that the clients are receiving accurate, targeted and quality communication, increases client retention, and the rate of acquisitions.

The availability of stronger fraud mitigation and early risk detection is another benefit of conducting sales through modern day technology due to the amount of criminal activity and fraud that is impacting the entire financial industry on a global scale. Any type of technology that offers a reduction or early detection will be in great demand in the industry as a whole.

Set yourself apart: improve differentiation to drive more sales

Strategies grounded in differentiation offer a wealth of opportunities for improving relevance and increasing revenue for your business.

- Look at making an investment in improved customer service not only in the branch but also with online sales and the service experience. After all, many of the most profitable financial institutions today have made large investments in improvements aimed at providing higher levels of quality client service. These investments were in the areas of campaign management systems, client analytics, CRM platforms, and systems integration.

- Work on ways to be the first financial institution to capture your core clients as they arrive in an area. This can be via mail, online, phone, etc.

- Make sure the software you are using can help you to accurately identify prospective clients and develop your relationships with existing clients.

- Work on improving your availability of mobile options for clients. Let’s not also forget that the mobile banking industry is growing at an extremely fast pace. Consider the fact that the online banking industry took over a decade to advance to where it is today but the mobile bank industry took less than four years to reach the same level of advancement. This is why so many retail financial institutions are making the financial investments needed to improve their online and mobile platforms.

- Look for technologies directed specifically at financial services businesses to enable your business to have the right platform to develop strong client relationships and close more sales.

- Take advantage of social media options that can be an additional strategically beneficial option for retail banking institutions by making use of Facebook, Twitter, WhatsApp, Wikipedia, and several other free online resources. Social media is a great way to advertise new promotions and opportunities provided by these institutions. Social media can also be used to provide feedback to the institutions to give them ideas and suggestions for improvements necessary to better meet the needs of the clients.

- Make use of online reviews that give new and existing clients the opportunity to see what sets one financial institution apart from the others. Research has shown that online reviews are one of the most important factors clients consider when choosing a financial advisor. Leading financial institutions today are also keeping their eye on what others are saying about them on social media.

- Make use of Two-way SMS Messaging/Alerts. This gives clients the ability to stay informed of what is happening with their accounts from just about anywhere.

These approaches, keeping one eye on opportunities for innovation, will help differentiate you from the competition.

Using Salesforce Financial Cloud, advisors can gain a better understanding of clients goals and help guide them to key investment decisions, helping investors manage their wealth more intelligently.

Source: The Financial Brand

Why are these financial services strategies so beneficial and profitable?

When advisors accurately make use of the available software options available to provide the most effective and efficient personalized services, this encourages the development of long-standing client-brand relationships.

The key is to adopt those strategies that make it possible, and easy, for your employees to go above and beyond to meet the needs of your clients. The use of a fast and effective customer relationship management software program can get you there.

By using the strategies listed above along with the right CRM software and analytics system, your financial institution could continue to be an innovative and profitable asset to clients.

Remember to pay close attention to new approaches in the industry, including developments in AI powered analytics and predictive intelligence. Consider how best you can apply strategies and integrated technology as a means of providing the highest level of satisfaction to profitable new customers, and gaining client loyalty. It is also important to watch out for any controls, risk factors, legalities, or global compliances that may need to be addressed along the way.

The main objective is to increase revenue by offering the best-fit, most effective products and services to new and existing clients while also being able to cut costs through further automation with financial transactions to lead rather than follow in the industry.

Need help with deciding which CRM is right for your financial institution? Contact our consultants and we will work with you to devise the perfect integration strategy, approach, and plan that will work with your budget and current infrastructure.