Satisfying digital-savvy clients with financial CRM

CRM encompasses the tools implemented for cultivating better customer relationships and interactions. An integrated financial CRM system is especially useful for companies in the wealth management business who need to develop intimate relationships with their customers to deliver an optimal product to achieve their desired financial outcomes.

Data source: http://www.infotechlead.com/software/salesforce-leads-crm-market-well-ahead-oracle-sap-49237

Salesforce launched its Financial Services Cloud, developed with the support of United Capital in August 2016. The launch was accompanied by a research study into investors that found that convenience, being able to have an account overview, and online reviews are the most important factors in choosing a financial advisor.

4 Benefits of CRM for wealth management companies:

1. CRM helps build trust that provides a competitive advantage

Trust is an important aspect of the client / wealth manager relationship and something which CRM software is able to underpin; being able to personalize customer relationships on a large scale is a source of competitive advantage for wealth management firms.

Additionally, CRM systems facilitate the development of long-term, dynamic relationships with customers. Professionals may always look back at historic customer information and identify trends in long-standing customer behavior to help them plan for the future. Mobile, artificial intelligence (AI), and analytics capabilities are ideally suited to wealth management and its digital-savvy customer base.

Financial CRM systems are ideal for wealth managers, enabling them to track and predict evolving customer needs, identify opportunities for their clients, and develop tactics accordingly in order to become trusted advisors improving clients’ ability to meet their lifestyle goals.

With Salesforce CRM for Wealth Management, clients are at the center of your business. Salesforce CRM captures data from multiple systems to help your business get a full 360-degree view of each and every client.

2. Financial professionals can customize their services better with CRM technology

Wealth management is different for everybody, and is often highly unique to an individual’s situation. Because of this, a thorough understanding of the customer’s circumstances, as well as their preferences, is critical.

A properly integrated CRM system allows for personalization, enabling financial professionals to craft products and services that are individualized and perfect for each of their clients. It integrates multiple communicative aspects, providing the ultimate platform for efficient interaction. Using this system, clients’ behaviors, preferences, and activities are logged to give a clear picture of each individual.

This gives wealth management companies the ability to review and analyze each customer’s personal profile, giving them a better understanding of the customer, and thus craft ways in which to achieve what the customer wants at every stage of their lifecycle.

3. CRM gives wealth managers quick access to meaningful data

Using CRM systems, financial professionals can log and track every task, appointment, and activity. CRM keeps information located in a single, compact database, allowing for easy access and understanding. Using this data analytics functionality, professionals can easily measure KPIs and generate reports (“Why CRM”, 2017).

Salesforce CRM for Wealth Management allows high-touch relationship management that pulls client data from multiple sources, which enables advisors to get the complete picture of their clients through a single unified interface accessible through any channel and device.

These features help firms stay on top of customer information, and deliver services in an organized and efficient manner. Ultimately, this efficient organization may help firms garner a competitive advantage, and make themselves far more attractive to potential new clients.

In addition, other benefits of CRM for wealth management companies include the ability to streamline customer profiles, assets, and investments, quickly giving professionals a holistic view of their clients’ finances whenever it is necessary.

4. Cloud-based CRM solutions allow for collaboration across the entire firm

Unlike traditional customer service systems, many CRM systems are cloud-based, meaning advisors and clients can access the system including client profile, history, documents, and related financial management tools regardless of their location and on any device (“How Can”, 2017).

This enables better collaboration between advisors, and keeps the entire team updated on important client information. Not only does this improve efficiency and succession planning within organizations but it also improves client experience, important in an industry where trust is of fundamental importance.

Overall

There are numerous benefits of CRM for wealth management companies. They allow for better organization, and because they are cloud-based, advisors and clients can access pertinent data regardless of their location.

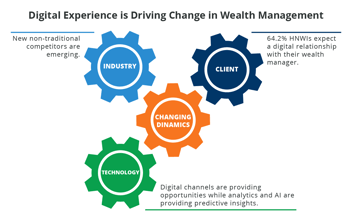

These solutions enable wealth advisors to get to really know their clients, so they can provide more personalized services. The graphic above shows how the evolution in CRM, the emergence of IoT, Big Data and AI mean that traditional wealth managers will be able to improve their digital competitiveness through predictive intelligence for scoring and selecting the most profitable leads, and shaping financial plans.

Need help with deciding which CRM is right for your financial institution? Contact our consultants and we will work with you to devise the perfect integration strategy, approach, and plan that will work with your budget and current infrastructure.

Leave a Comment